Digitalization is transforming business and tax operations around the world. In response to this shift, the European Commission has launched a project called VAT in the Digital Age (ViDA).

ViDA is an initiative designed to modernize and optimize the VAT system within the European Union. The main objective of this ambitious project is to close the VAT gap, estimated at €99 billion in 2020, and improve the efficiency of tax collection through the adoption of innovative technologies and real-time reporting systems.

What does the ViDA initiative address?

ViDA focuses on several key pillars aimed at addressing the current challenges of the VAT system across Europe:

- Real-time reporting for B2B intra-EU transactions. This system will allow companies to share electronic invoicing data with tax authorities immediately, improving transparency and transaction control. By enabling member states to monitor VAT revenues in real-time, a significant reduction in tax fraud and increased efficiency in resource management is expected.

- Harmonized framework for service platforms. ViDA will introduce uniform rules for applying VAT to digital platforms that facilitate passenger transport and short-term accommodation. This ensures that VAT is applied fairly and equitably across all member states.

- Cost reduction for companies. Operating across borders often involves high administrative costs. ViDA aims to reduce these costs by simplifying VAT compliance requirements for businesses operating in multiple EU countries.

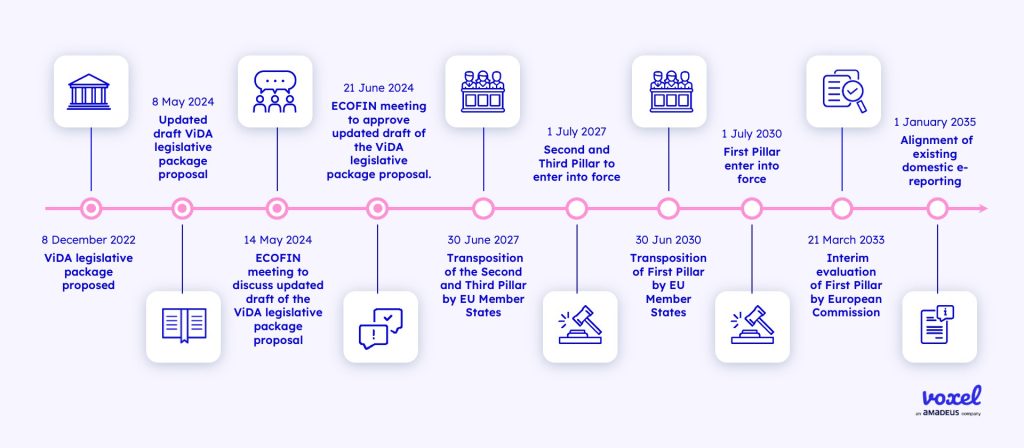

ViDA project phases

The ViDA project will be implemented in several phases. Currently, implementation includes:

- First phase: Digital Reporting Requirements (DRR). Member countries will need to adopt a standardized real-time transactional reporting model for B2B transactions, with electronic invoicing as the default method.

- Second phase: Platforms as Deemed Suppliers (PDS). EU member states will need to apply VAT rules to digital platforms facilitating the sale of services such as transport and accommodation, with these platforms acting as responsible entities for VAT collection.

- Third phase: Single VAT Registration (SVR). Expansion of the One-Stop Shop (OSS) and Import One Stop Shop (IOSS) regimes, allowing companies to register in a single member state for all their operations within the EU.

Electronic invoicing at the heart of the ViDA project

Electronic invoicing at the heart of the ViDA project

A key aspect of the ViDA project is mandatory electronic invoicing, which is positioned as the engine of digital transformation in VAT management. This approach, combined with Continuous Transaction Controls (CTCs), will allow tax authorities to receive, validate, and monitor each transaction in real-time. This system not only facilitates fraud detection but also helps improve the quality and accuracy of tax data.

Although ViDA guidelines are not yet in force and do not have a clear timeline, many countries are already advancing in the implementation of mandatory electronic invoicing for B2B transactions.

Italy was the pioneer in implementing this technology in 2018. Other countries, such as Spain, Germany, France, and Romania, among others, are actively working on implementing mandatory e-invoicing with concrete timelines for the coming years.

How does ViDA affect companies?

For companies, ViDA represents a significant change in how they manage their transactions and tax reports. In the coming years, and depending on the regulations of each country, they will need to adapt their technological systems to comply with electronic invoicing requirements and ensure their operations align with the new EU regulations.

Adapting processes in general, and electronic invoicing in particular, involves an initial investment, but the medium and long-term benefits are significant: reduced administrative costs, greater operational efficiency, and better integration with tax authorities.

According to estimates from KPMG, the savings in administrative costs are projected to be €51 billion between 2023 and 2032, compared to an implementation cost of €13.5 billion. This difference highlights the potential benefits of early adoption of ViDA regulations.

Voxel’s role in the Implementation of ViDA

Voxel’s role in the Implementation of ViDA

At Voxel, we understand that transitioning to electronic invoicing can be a challenge, but also an opportunity to invest in the technological innovation of internal processes and take advantage of the benefits that digitalization offers.

As leaders in electronic invoicing and B2B payment solutions, we are prepared to support companies in this transformation, ensuring they comply with the requirements of the ViDA project and the specific laws of each country.

Voxel, through the Bavel platform, integrates with companies’ management systems, helping them manage their transactions and VAT reports in real-time without compromising data quality or security.

The ViDA project represents a key advance in the digitalization of tax administration in Europe. Companies must be prepared to adapt to these new regulations and maximize the benefits of this VAT modernization. At Voxel, we are committed to being the ideal technology partner on this journey, offering efficient solutions to meet legislative demands.

Voxel’s role in the Implementation of ViDA

Voxel’s role in the Implementation of ViDA