*Last update: 09/13/2023*

European countries continue to make progress in legislating electronic invoicing. Executive managers are studying what model of electronic invoice to implement, forms, schedules, etc. As well as the endless details that companies need in order to adapt their processes. Meanwhile, the European Union has already expressed their desire to standardize the processes and forms related with electronic invoicing in 2029.

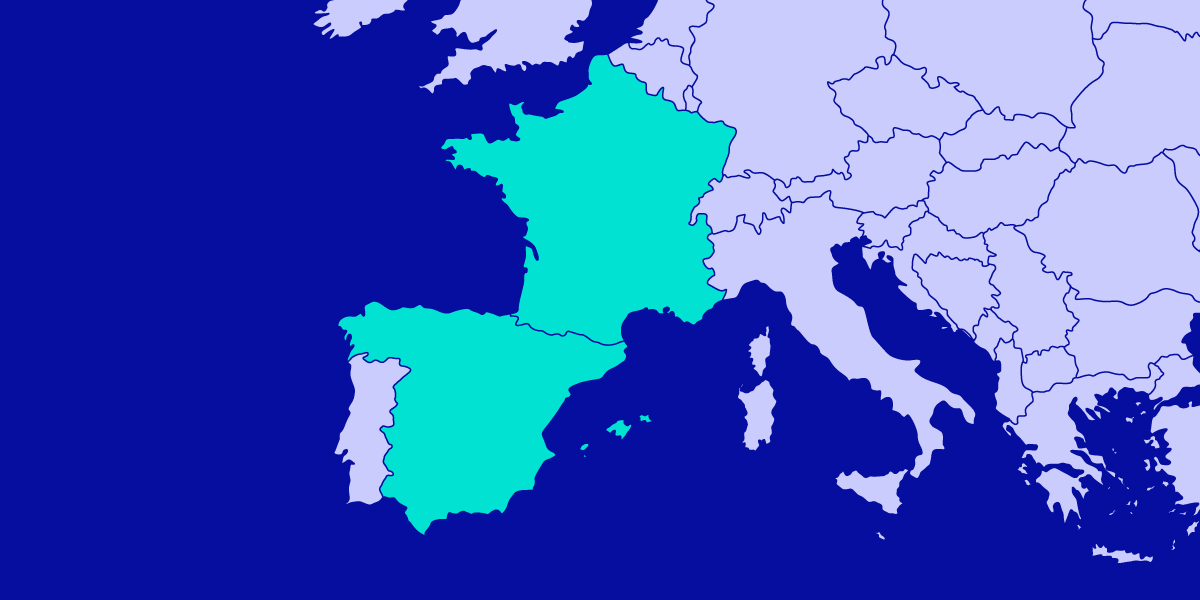

Until then, new legislation is continuously being enacted. In today’s blog, we will be covering the latest news on mandatory e-invoice regulations in Spain and France.

The Spanish model is being created

Since the publication of the “Crea y Crece” (Create and Grow) Law, this past month of September, 2022, The Ministry of Economic Affairs and Digital Transformation is working on designing the mandatory e-invoice project in Spain.

A public consultation was opened in March regarding the project outlined in the Royal Decree that covers electronic invoicing. On June 20, the draft of the Royal Decree was published. From now on, and until July 10, a period of allegations opens so that the affected companies can give their feedback to the Public Administration.

Once this period of allegations is concluded, there is a resolution period. The last step is the approval of the Royal Decree and subsequent publication in the Official State Gazette (BOE).

Delays in France

Delays in France

In January 2022, France received authorization from the European Union to implement the mandatory use of the electronic invoice for domestic transactions between companies. Since then, the country has made progress on their plan, schedule and the designing of technical specifications for their e-invoice process.

The electronic invoice model designed by France, model Y, has three key actors: the issuer of the invoice, the suppliers and the government. To participate in the transfer of information, technology suppliers must become a PDP (Platform of Dematerialization Partner).

It is precisely in this area where France has fallen behind. The requirements for becoming a PDP should have been made public in March of 2023 but have still not been published.

Subsequently, the French government issued a press release announcing the postponement of the entry into force of the mandatory e-invoicing requirement, scheduled for 1 July 2024 for large companies. The new timetable has not yet been published.

You can find all the details about the B2B electronic invoice in France on Voxel’s website.

If you want to know the status of the mandatory electronic invoice in other European countries, please refer to our guide “The panorama of the Electronic Invoice in Europe”. Make sure you stay up to date!